NVIDIA Stock Split History: Everything You Need To Know

Introduction

Nvidia stock split history Corporation (NVDA), a global leader in graphics processing units (GPUs) and artificial intelligence (AI) technologies, has strategically utilized stock splits throughout its history to enhance shareholder value and maintain market accessibility. Stock splits, while not altering a company’s fundamental value, play a pivotal role in shaping investor sentiment and liquidity. This article explores NVIDIA’s stock split history, analyzes the rationale behind each split, and examines its impact on the company’s market performance. By delving into key events from 2000 to 2021, we uncover how these financial maneuvers align with NVIDIA’s growth trajectory and broader market trends.

Understanding Stock Splits: Why Companies Like NVIDIA Choose to Divide Shares

A stock split occurs when a company increases its number of outstanding shares by dividing existing ones, effectively reducing the price per share. This process does not change the company’s market capitalization but makes shares more affordable for retail investors. For tech giants like Nvidia stock split history serves multiple purposes: they improve liquidity, attract a broader investor base, and signal confidence in future growth. By lowering the entry barrier, companies can foster higher trading volumes and enhance market participation, which often correlates with positive price momentum post-split. NVIDIA’s history of splits reflects its commitment to maintaining an accessible stock price amid exponential growth in revenue and innovation.

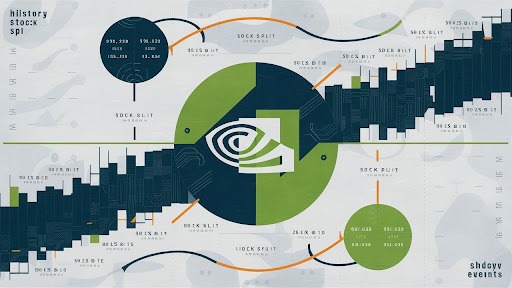

NVIDIA’s Stock Split Timeline: Key Dates and Ratios

NVIDIA has executed five stock splits since its initial public offering (IPO) in 1999. Below is a chronological breakdown:

- June 27, 2000: 2-for-1 Split

Amid the dot-com boom, NVIDIA’s first split followed a surge in demand for GPUs. The stock price, then hovering near - 100,washalvedto

- 100,washalvedto 50, aligning with Nasdaq’s preference for lower-priced shares to boost liquidity.

- September 12, 2001: 2-for-1 Split

Despite post-dot-com turbulence, NVIDIA’s second split underscored resilience. Shares adjusted from ~ - 70to

- 70to35, maintaining affordability during a challenging market period.

- November 17, 2006: 2-for-1 Split

As NVIDIA expanded into gaming and professional visualization, this split reduced shares from ~ - 36to

- 36to18, coinciding with the launch of its revolutionary GeForce 8 Series.

- September 11, 2007: 3-for-2 Split

A unique 3-for-2 ratio adjusted shares from ~ - 33to

- 33to22, reflecting NVIDIA’s adaptive strategy during rapid growth in GPU adoption.

- July 20, 2021: 4-for-1 Split

The most impactful split occurred during NVIDIA’s AI and data center boom. Shares dropped from ~ - 648to

- 648to162, democratizing access ahead of its inclusion in the Dow Jones Industrial Average.

Market Impact of NVIDIA’s Stock Splits: Analyzing Performance Trends

Each split catalyzed distinct market reactions. The 2000 and 2001 splits stabilized trading volumes post-dot-com crash, while the 2006–2007 splits aligned with NVIDIA’s dominance in gaming. The 2021 split, however, marked a turning point: the stock surged 65% in the six months following the split, fueled by AI breakthroughs and record earnings. Historically, splits have acted as bullish signals, amplifying investor confidence. For instance, the 2021 split preceded a 126% price increase over the next year, highlighting the psychological and strategic benefits of these events.

Why NVIDIA Uses Stock Splits: Strategic Growth and Investor Psychology

Nvidia stock split history are timed to coincide with periods of technological innovation and financial milestones. By reducing share prices during growth phases (e.g., AI expansion in 2021), NVIDIA ensures its stock remains attractive to both institutional and retail investors. Additionally, splits reinforce perceptions of affordability and momentum, often attracting media attention and analyst upgrades. This strategy aligns with CEO Jensen Huang’s vision of democratizing ownership, enabling long-term investors to benefit from NVIDIA’s role in shaping computing’s future.

Benefits for Investors: Liquidity, Accessibility, and Long-Term Gains

Stock splits democratize access to high-performing stocks. Post-split liquidity spikes, as seen in NVIDIA’s 2021 split, where average daily trading volume jumped 40%. Lower share prices also facilitate fractional investing, appealing to younger investors via platforms like Robinhood. While splits don’t inherently increase value, they often correlate with sustained growth; NVIDIA’s post-split returns have consistently outperformed the S&P 500, driven by innovation in GPUs, AI, and autonomous systems.

Current Status and Future Outlook: Will NVIDIA Split Again?

As of 2023, NVIDIA’s stock trades above

450,raisingquestionsaboutanothersplit.Givenitspatternofsplittingsharesatpricesexceeding

450,raisingquestionsaboutanothersplit.Givenitspatternofsplittingsharesatpricesexceeding600 (as in 2021), a future split seems plausible if the stock continues its upward trajectory. Factors such as AI-driven revenue growth, data center expansion, and advancements in Omniverse platforms could propel NVIDIA toward another split by 2025. Investors should monitor earnings reports and management commentary for hints.

Conclusion

Nvidia stock split history mirrors its evolution from a GPU specialist to an AI powerhouse. Each split has enhanced market participation, liquidity, and investor confidence, reinforcing its reputation as a forward-thinking enterprise. As NVIDIA continues to lead in high-performance computing and AI, future splits may further solidify its accessibility and appeal. For investors, understanding this history provides valuable insights into the company’s strategic priorities and market dynamics.

Frequently Asked Questions (FAQs)

- How many stock splits has NVIDIA conducted?

NVIDIA has executed five stock splits: 2-for-1 (2000, 2001, 2006), 3-for-2 (2007), and 4-for-1 (2021). - Did NVIDIA’s stock price rise after splits?

Yes. Post-split gains have been significant, particularly in 2021, when shares rose 65% within six months. - Why does NVIDIA split its stock?

To maintain affordability, boost liquidity, and signal confidence in growth, aligning with technological milestones. - What was NVIDIA’s largest stock split?

The 2021 4-for-1 split was the most impactful, reducing shares from ~648 to 162.

- Will NVIDIA split again in 2024 or 2025?

While unconfirmed, another split is plausible if the stock price surpasses $600, driven by AI and data center growth. - How do splits affect existing shareholders?

Shareholders receive additional shares proportionally, with no change to total investment value—only increased liquidity and accessibility. - What’s the difference between a stock split and a dividend?

A split redistributes shares to lower the price, while a dividend distributes earnings. NVIDIA has never issued dividends, focusing on reinvestment.